🏡 Balancing Housing Affordability and Policyowner Resilience: Bridging Exposure Gaps Amidst Federal Policy Rollbacks

Key Discussion Areas

This paper navigates the compounding pressures on the housing market, examining how federal legislative and trade policies intersect with consumer-level insurance protection.

Federal Policy Destabilization: The analysis details how protectionist tariffs on construction materials and the rollback of clean energy credits via the One Big Beautiful Bill Act (OBBBA) inflate housing costs, energy expenses, and threaten critical safety nets (Medicaid, SNAP), disproportionately impacting low-income households.

Policyowner Indemnification: It investigates the critical role of Public Adjusters (PAs) as consumer advocates in insurance claims, scrutinizing proposed fee caps that threaten access to expert representation.

Bridging Exposure Gaps: The discussion highlights the legal and financial exposure created by insurers undervaluing claims and debates the necessity of Assignment of Benefits (AOB) to allow consumers to obtain fair payment for repairs.

Leveling Regulatory Changes: The conclusion explores institutional advocacy—from groups lobbying for tariff exemptions and the protection of the CFPB, to the recommendation of a federal reinsurance program—and the need for enhanced PA licensing and contract transparency (e.g., Pennsylvania's H.B. 1972/S.B. 1074) to protect consumers during catastrophic events.

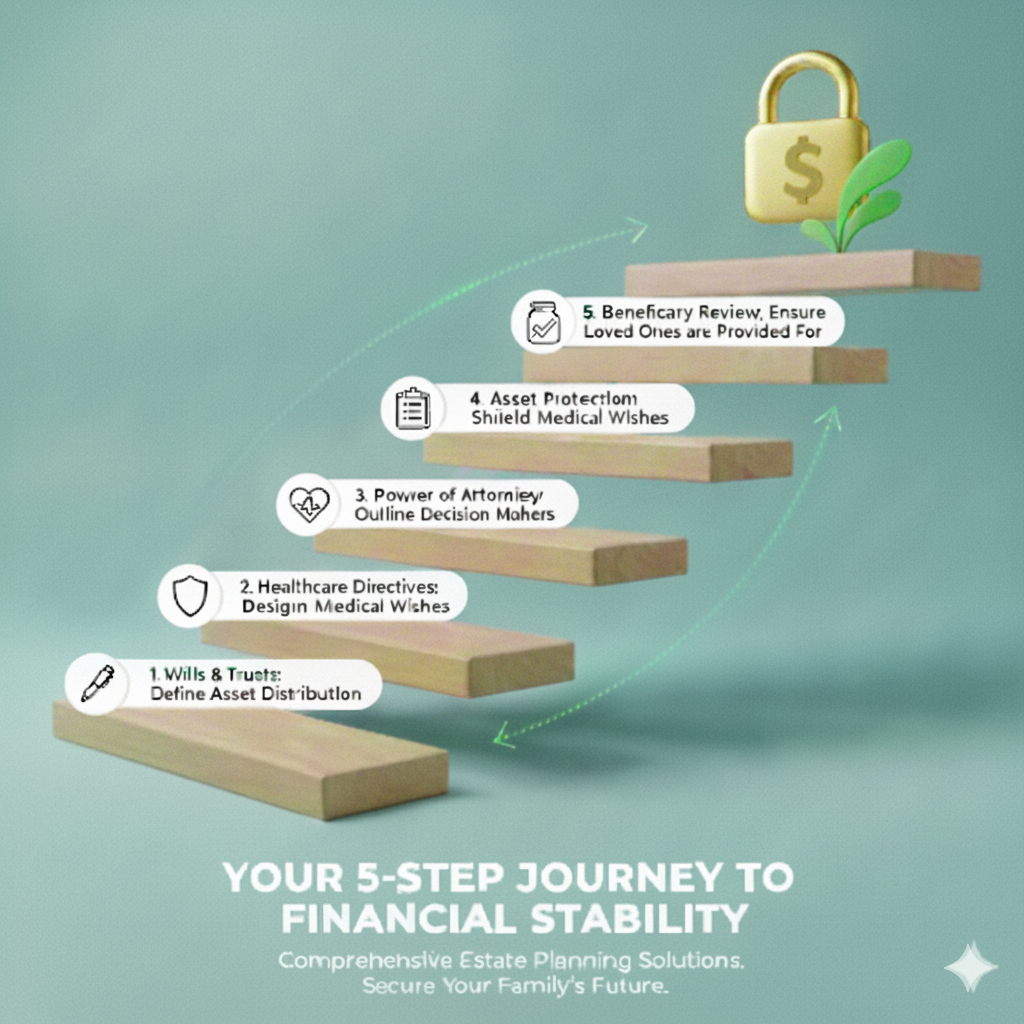

Why do I need to start thinking about estate planning? (Copy)

📰 The article argues that recent legislative and political changes, specifically the passage of the controversial One Big Beautiful Bill Act (OBBBA), create an immediate and urgent need for all individuals to start or update their estate planning.

Delaying planning exposes families & businesses to unnecessary tax burdens, legal confusion, and regulatory complexity.

Key Impacts of the OBBBA

The article highlights a "dual reality" created by the OBBBA, impacting different groups in distinct ways:

The Opportunity (for the Affluent):

Estate Tax Shield: The OBBBA permanently increases the federal estate and gift tax exclusion to $15 million per individual starting in 2026.1 This requires immediate action, such as trust restructuring and asset basis management, to leverage this opportunity and protect wealth.

New Accounts: The creation of new, tax-deferred "Trump Accounts" for children also requires proactive financial planning.2

The Immediate Burden (for Everyone Else):

W-2 Wage Shock: Starting January 31, 2026, a new federal income tax deduction for "Qualified Overtime Pay" forces employers to reconfigure payroll systems.3 This creates compliance obligations, increases scrutiny on paychecks, and raises the risk of wage-and-hour disputes.

Regulatory Uncertainty: Changes in IRS enforcement and the rejection of legal precedent make the legal standing and reporting requirements for trusts less predictable. This mandates that fiduciaries immediately review existing trusts.

Systemic Inefficiency: Measures that block automation in programs like Medicaid and complicated cost-shifting rules in SNAP create systemic failures, shifting the burden of time, stress, and financial cost onto the individual.

📢 The Call to Action

The article concludes with a strong message for procrastinators: "The political world is defined by constant change." Every legislative shift, like the OBBBA, creates a deadline for planning. The author promises to help readers review their policy, assess risks, and execute the necessary documentation to secure their assets and inheritance now, rather than waiting until the next "One Big Beautiful Bill" forces their hand.